Savings bond tax calculator

Compare taxable tax-deferred and tax-free investment growth. Our Tax and National Insurance NI calculator will provide you with a forecast of your salary as well as your National Insurance Contributions for the tax year of 202223.

Realty Finance Articles Rera Rules Rera News Rera Compliances Rera In India Rera Calculator Invest Wisely Where To Invest Best Money Saving Tips

How much self-employment tax will I pay.

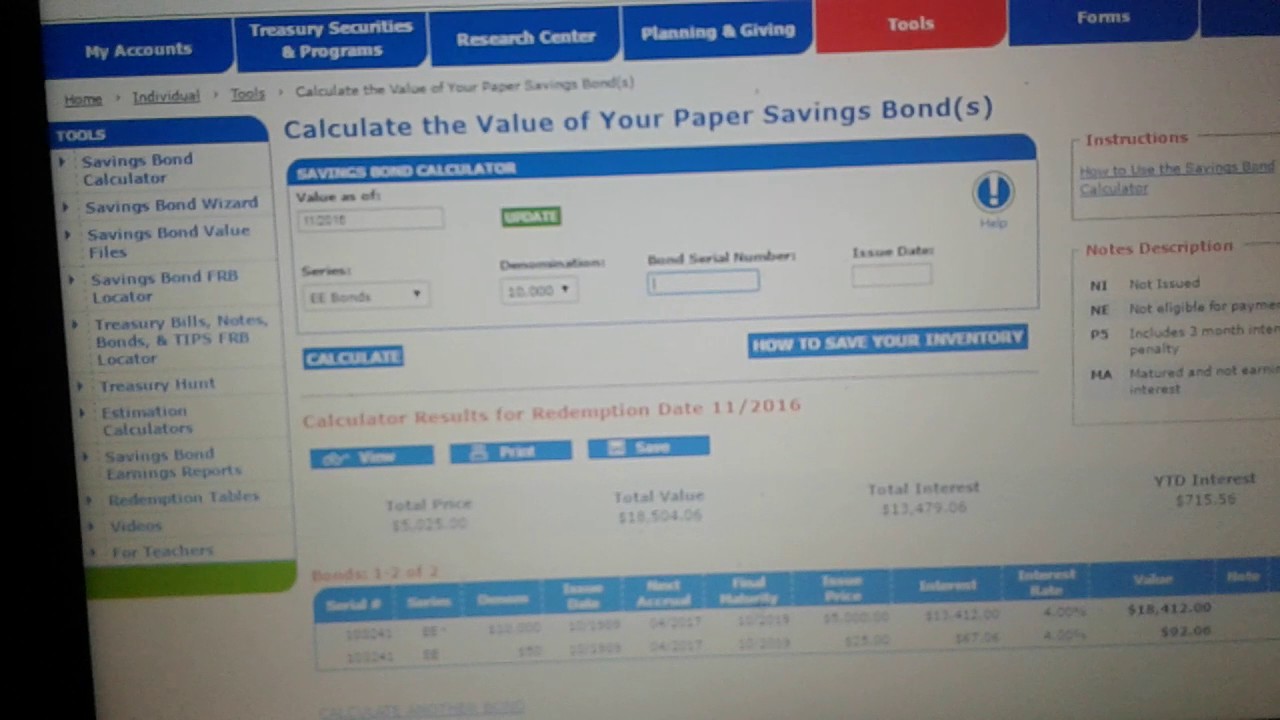

. Can be redeemed after a year. Should I adjust my payroll withholdings. The Calculator can show what your paper bonds are worth in any month from January 1996 through the current rate period.

The Green Savings Bond is a three-year fixed savings account that uses savers cash to fund green infrastructure projects. Calculating Yield to Maturity on a Zero-coupon Bond. How much you may save with tax credits discounts.

The 739B measure carries a host of tax credits and discounts on everything from electric cars to. Will my investment interest be deductible. Just connect to the Internet locate the bond list you saved on your computer and open the file.

Limit buyers to 10000 in savings bond purchases each year. It is taxed as a normal income. Click here for a 2022 Federal Tax Refund Estimator.

Federal Income Tax Calculator 2022 federal income tax calculator. Click on the Return to Savings Bond Calculator button at the top of the page and your list will automatically update the values to the current date at that time. We think its important you understand the strengths and limitations of the site.

This Calculator provides values for paper savings bonds of these series. Capital gains losses tax estimator. NSC or National Savings Certificate is a Government Savings Bond which is useful for a small investment and tax saving.

If you report savings bond interest to the IRS every year. They can also offer tax advantages over similar products such as a savings account or certificate of deposit CD. Roll Savings Bonds Into a College Savings Account.

Here is an example calculation for the purchase price of a 1000000 face value bond with a 10 year duration and a 6 annual interest rate. These certificates can be acquired by any Indian resident from any post office across India. Provides historical savings bond value files which contain pricing data for all issued I EEE Series bonds andor Savings Notes.

Here are the current interest rates for 1-Year Fixed-Rate Savings Bond - Issue 89 plus account information. For example you can buy a 2873 savings bond. Taxes are unavoidable and without planning the annual tax liability can be very uncertain.

Once open choose the series and denomination of your paper bond from the series and denomination drop-down boxes. To use our free Bond Valuation Calculator just enter in the bond face value months until the bonds maturity date the bond coupon rate percentage the current market rate percentage discount rate and then press the calculate button. Tax savings for.

There are some advantages to either approach. 2022 federal income tax calculator. How much of my social security benefit may be taxed.

Carry a penalty if redeemed in under five years three months of interest will be withheld. Savings bonds can be one of the safest ways to earn money on your savings as a savings bonds value is backed by the full faith and credit of the US. To find what your paper bond is worth today.

Bond Yield to Maturity Calculator. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. The page will look just like it did when you saved your list.

Version 9 - 11. Another strategy for how to avoid taxes on savings bond interest involves rolling the money into a college savings account. Were a journalistic website and aim to provide the best MoneySaving guides tips tools and techniques but cant guarantee to be perfect so do note you use the.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. SeriesThe series can be found in the upper right corner of your paper savings bond. Tax and financial aid treatment of 529 plans is subject to change.

There are certain exceptions such as municipal bond interest and private-activity bonds. Money Market Account MMA Calculator. Are available in non-standard denominations to the penny.

Savings Bond Calculator at treasurydirectgov - Includes the effect of federal taxes. Click the Get Started Link above or the button at the bottom of this page to open the Calculator. When you have this data you can utilize an investment funds security number cruncher to discover how much your security is worth at the present time.

You can roll savings bonds into a 529 college savings plan or a Coverdell Education Savings Account ESA to avoid taxes. And is managed by American Century Investment Management Inc. We use a database built from these source files to evaluate the price of your bonds.

Its available through National Savings Investments NSI and pays 3 AER. Tax liability on interest applies in the tax year it is paid which may be different to the tax years in which interest has accrued. The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bonds term.

Inflation Reduction Act savings calculator. Savings bond calculator To compute the estimation of your investment funds securities youll need to know its sort division chronic number and issue date. View pricing data between May 1992 and May 2020.

As with any investment it is possible to lose money by investing in this plan. The Schwab 529 Education Savings Plan is available through Charles Schwab Co Inc. As interest continues to rise across the board you can easily beat this rate with traditional savings accounts.

Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. National Saving Certificates were first introduced in the 1950s to facilitate the nation-building process. This means you could reach or exceed your Personal Savings Allowance more quickly in that tax year.

Short Term Capital GainsLossesprofit or loss from the sale of assets held for less than one year.

How To Calculate Value At Risk Var In Excel Investing Standard Deviation Understanding

Download Schedule B Calculator Apple Numbers Template Exceldatapro Number Templates Templates Apple

How To Calculate The Annual Rate Of Return On A Bond Our Deer Bond Annual Finance Advice

Excel Optimal Hedging Strategy Template Optimization Risk Aversion Excel Templates

What Is The Rule Of 72 And Why Does It Matter The Budget Mom Rule Of 72 Budget Mom Investing

Individual Savings Bond Calculator Inventory Instructions

I Bonds A Very Simple Buying Guide For 2022 In 2022 Tax Refund Buying Guide Federal Taxes

Iifcl Tax Free Bonds Tax Free Bonds Tax Free Bond

Download Schedule B Calculator Excel Template Exceldatapro Excel Templates Federal Income Tax Calculator

What Is The Rule Of 72 And Why Does It Matter The Budget Mom Rule Of 72 Budget Mom Investing

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire Breaks Out His Spreadsheets To Calculate And Quan Roth Ira Calculator Roth Roth Ira

How To Create Your Personal Net Worth Statement And Why You Need It Personal Financial Statement Finance Saving Budgeting Money

Pin On College Savings

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Finding Your Treasury Direct Bond On The Calculator Bond Birth Certificate Statement Template

The Financial Planning Flowchart Financial Planning Flow Chart Financial

These 12 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin Finance Investing Economics Lessons Money Concepts